Week of August 21, 2023

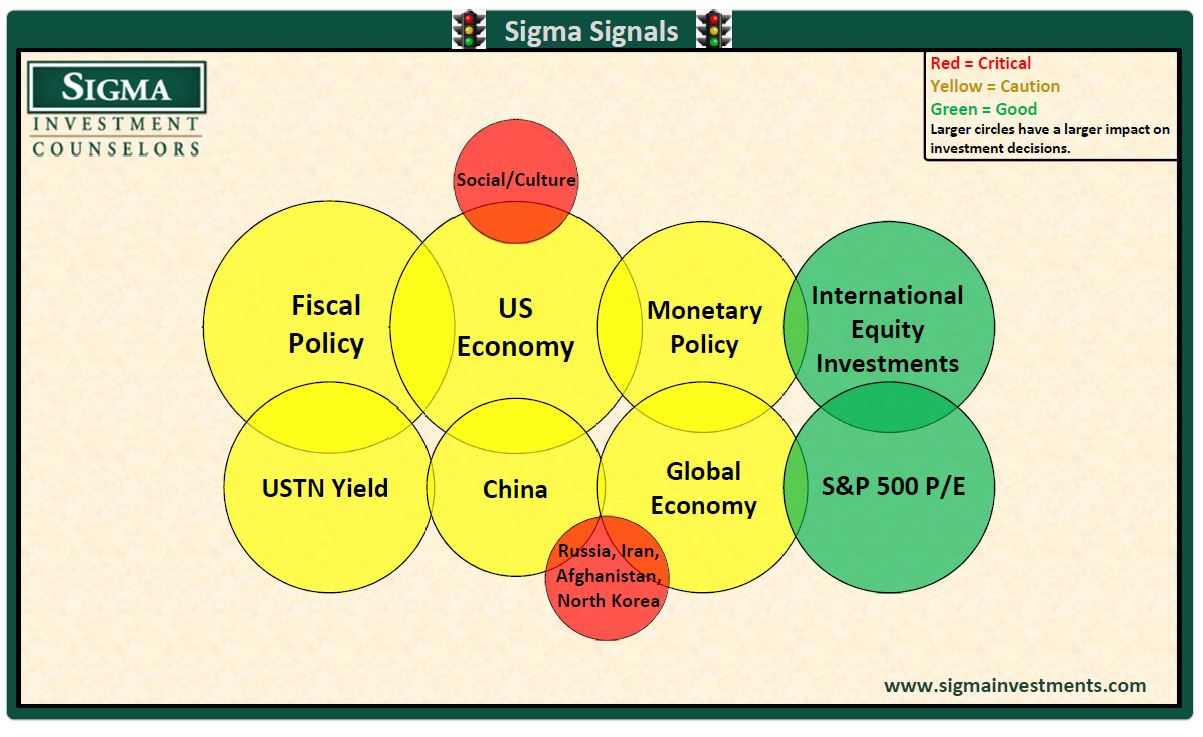

Prior to the inflation surge that occurred in the United States in the mid-1970s, US 10-year Treasury Note yields averaged between 4 1/2% and 6% in the mid-1960’s. Today, the 10-year Treasury Note yields 4.25%, suggesting yields have nearly normalized. This assumes inflationary pressures continue to moderate. If inflation remains stickier than expected, yields may push higher into the historical 4.5% to 6% range. Not surprisingly, the Standard & Poor’s 500 stock index moved moderately lower in the last week. Our Signals remain unchanged.

Bob Bilkie, CFA