Week of July 31, 2023

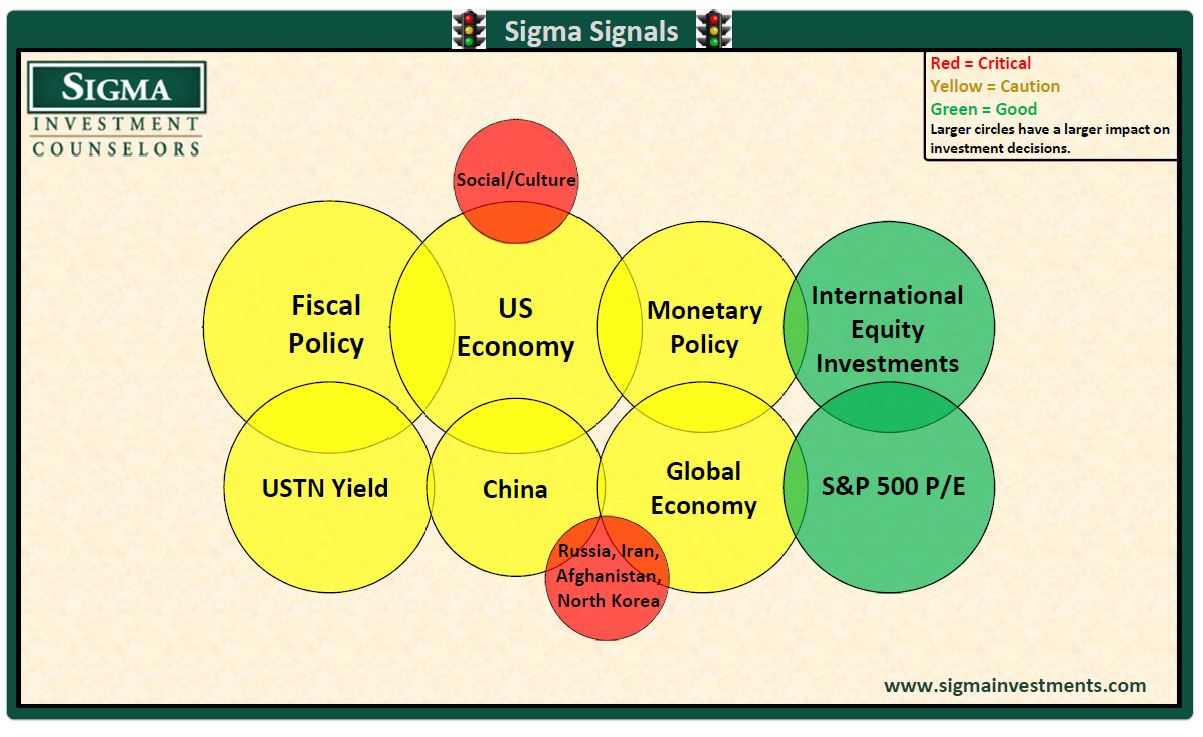

Gold spiked up last week to within 5% of its all time high reached in April. The one-month US Treasury Bill yield also spiked up to a 20 year high at 5.4%. Typically, rising rates on short term treasuries portends a drop in inflationary expectations which would lead to a WEAKENING gold price, not a RISING one. Gold prices reflect geo-political risks as well though, and therefore this pattern may suggest rising tensions and angst. Nonetheless, common stock prices on major averages remain in an uptrend, portending general improvement in corporate profitability. Our Signals remain unchanged.

Bob Bilkie, CFA